Remember the time when you used to visit banks for any transaction?

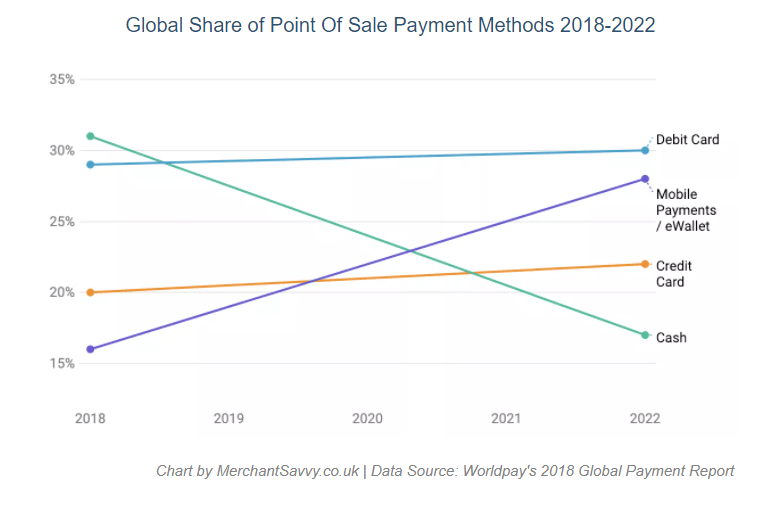

We all were accustomed to the modes of payment where debit cards, credit cards, cash, and cheques were the usual means to pay.

When you wanted to transfer money to a friend or relative, you used to meet the person individually or mail a cheque or cash.

Besides, if you overestimated your account balance, bounced a check, made a delayed credit card payment, or deposited your paycheck late, you used to encounter high fees.

Fortunately, mobile apps have changed the way we transact!

Highlights of Contents

Increasing Demand for Mobile Payment Apps

As per eMarketer, it is predicted that by 2023 the usage of mobile payment apps is going to increase to 1.31 billion people globally.

According to IMARC, $3,081 billion estimated worldwide payment market by 2024, which is an immense increase from the $1, 146B in 2019.

As per the 2019 Mobile Payments Market- Trends, Growth, and Prediction (2020-2025) survey by Mordor Intelligence, the adoption of mobile payment will continue its relentless increase with a CAG rate of 26.93 percent between 2020-2025.

Before discovering the best mobile applications for payment, let’s just find out the advantages of using these apps.

What are the Benefits of Mobile Apps?

1. Makes Money More Safe

In current years, cybersecurity violations uncovered customer payment information to find the thieves that have tried to perform some misdeeds. However, the breaches are more precisely the difficulty of the organizations they befell.

Their databases were hacked, and the thieves got the information arranged and waiting. The businesses could have removed the data rather than saving it, as numerous people do now.

On the whole, mobile payment apps are making our money more protected. In case, we carry a huge amount of cash, and it’s stolen, the bank does not restore it.

Also, if funds from a payment card or a Smartphone app are falsely spent, the service provider refills them; although, the procedure can be slow.

Getting your cash stolen is just like being held accountable for what the thief buys with the money.

Keeping some amount of money in your wallet is inevitably a good notion because a few businesses still run on the cash model. However, when you require spending big money, digital cash is secured than paper.

2. Make Transactions Quick

With the help of these mobile payment apps, you can execute transactions that may take some days to confirm. Yes, using payment mobile apps is quite easy and quick. Just take the example of Paytm, which has now become one of the popular apps among users.

We all have this app on our mobile to execute payments. This app has vanished the need of carrying money into the pocket. Similar to this app, numerous applications have been introduced in the market.

3. Advances Economic Growth

Mobile payment applications make a noteworthy stamp on the financial landscape. As per an app analytics organization App Annie, by 2021, the global app economy will worth $6.3 trillion.

One of the key income drivers is online buys with cell phones, particularly for trivial items. When we can arrange immediately with a cell phone, gone is the holdup time to make the buy-in store, from a work area at home, or through the mail.

Moreover, to help the consumer spend, the mobile payment app industry causes them to earn money. The business’ extension makes employment, from programming to the development of paid apps to the positions in client service at e-wallet providers.

Moreover, the process of mobile payment has greatly evolved without creating other installment techniques old-fashioned. It has introduced new employment without killing 5 Innovative Mobile Payment Apps

Most Popular Apps to Make Payment

Paying with a mobile phone is simpler than ever. Advance mobile payment applications are giving users new means to transfer money with peers, use alternative currencies, manage expenditures, purchase products, earn rewards, and more.

Here are a few apps that make your transactions effortless.

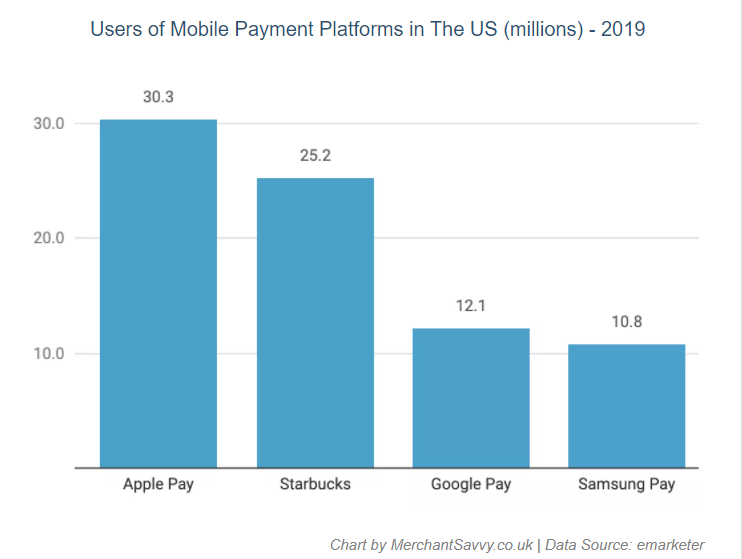

1. Google Pay

Google Pay is a quick and easy method to pay online, as well as in physical stores.

This app lets you check out hundreds of applications without entering the payment detail. Google Pay Send, which is a peer-to-peer facility in Google Pay, has substituted the Google Wallet service.

This feature allows you to pay anyone through a phone number or an email address. Besides, when you pay via Google Pay, it doesn’t share your card information with the vendor, but an encrypted number.

2. PayPal

PayPal is one of the first applications for digital payment. This app is free to utilize if connected to a bank account or if you hold a Paypal Cash bank account. In case, you start a transaction with the help of a credit card, there is a 2.9 percent fee.

Regular transfers require 1 to 3 days to occur in your account. Real-time transfers occur immediately but are credited a 1 percent transaction fee.

3. Venmo

Owned by PayPal, the app is the third most famous finance application in the App Store. As soon as you install it, you can request or send payment from or to anyone in the United States with an account on Venmo.

It is free if the sum comes from a bank account, prepaid debit card, or debit card. For money funded through a credit card, the app charges a 3 percent transaction fee.

Money transfer to an account commonly takes between 1 and 3 days to clear. There is a choice for a real-time transfer, which is executed in 30 minutes/less.

4. Apple Pay

Apple Pay is a simple, reliable way for consumers to spend on products, services, and subscriptions, as well as make donations. Users validate payments and give contact and shipping details with watchOS and iOS or websites in Safari.

Besides, the payment app can be utilized in Business Chat and iMessage extensions. Users use credentials safely saved in their systems, including double-clicking Apple Watch, Face ID, and Touch ID to keep private data secure.

Organizations can provide express checkout by showcasing the Apple Pay on the cart or product pages, which permits users to perform their buys with one touch.

Interpreting transactions can assist in enhancing conversion rates by reducing cart abandonment. Apple Pay combinations work with well-known eCommerce platforms, including WooCommerce, Shopify, BigCommerce, IBM, GoDaddy, Salesforce, Miva, Symphony, and Volusion commerce.

Companies can even build contactless tickets for gifts, as well as rewards cards to promote mobile payments and reform business.

5. Samsung Pay

Users can use Samsung Pay online and in-app via loading the cards into the pocketbook on their smartphone and financing for their possession with one tap.

Samsung Pay generally does not need any extra or upgraded tools for users to make transfers. It does not need an NFC-enabled terminal, as well as functions almost anywhere users usually use their credit cards.

The app lets users earn cashback and receive rewards for daily purchases. Besides, each purchase is enclosed through the fraud protection of bank or issuer credit card.

Transactions must be validated by the PIN of the card owner, iris scan, or fingerprint. Samsung Pay combines safe functionalities into the application, including tokenization and Samsung Knox, to add additional layers of protection.

The Future of Mobile Payment Apps

Mobile payments have come a long way ever since the mid-1980s when American cryptographer David Chaum set out to make digital cash and founded the utilization of digital currencies, yet there’s a lot of space for development.

Stats demonstrate that, among shoppers, mobile payment apps have progressed quicker than it has been grasped.

For the mobile payment app industry to appreciate the rich future researchers foresee, obstructions in customer thinking must be crushed, especially fears about the payment app security.

Addressing the lag in the compatibility between cash-based and money installments is additionally essential because numerous need a basic strategy for loading money into a paid app.

Find Thoughts

Mobile payment applications are transforming monetary transactions across the globe. They have made payments effortless than ever.

Since these applications are turning our lives simpler, there is an extensive opportunity reclining beside mobile payment apps.

Besides, 2021 has much to contribute to the payment ecosystem. Corporations need to gear up to stay ahead of the trajectory by providing global, seamless, secure, and agile payment systems.

Frequently Asked Questions

Q1: What are mobile payment apps?

A1: mobile wallet is a mobile app that saves your credit as well as debit card information allowing you to pay for goods digitally with a mobile device.

Q2: Which is better, Cash or Venmo?

A2: Venmo is utilized when you are searching for a specific investment with your roommates or friends. In case you wish to transfer funds or pay bills, then Cash is better.

Q3: Which is the most secure money transfer app?

A3: Google Pay and PayPal are the most protected mobile payment applications. Mobile apps, such as Apple Pay and Cash, have their sole proprietary algorithm, which preserves their online payments.

Q4: What is the name of the best international money transfer mobile app?

A4: Venmo, World Remit, Western Union, PayPal, TransferWise, Azimo, and more are a few of the famous and trustworthy international money transfer applications.

Awesome post. I am a regular visitor of your website and appreciate you taking the time to maintain the excellent site. I will be a regular visitor for a really long time.

Having read this, I thought it was really informative. I appreciate you spending some time and energy to put this article together. I once again find myself personally spending way too much time both reading and leaving comments. But so what, it was still worth it!

hi! I really like your writing so much! you are a professional in this. Great job

Your blog is amazing.

Very informative blog article. Much thanks again. Online payment especially mobile payment is the upcoming trend.

Thanks for the amazing blog. I personally like the benefits part.

Please publish more blogs.