Highlight

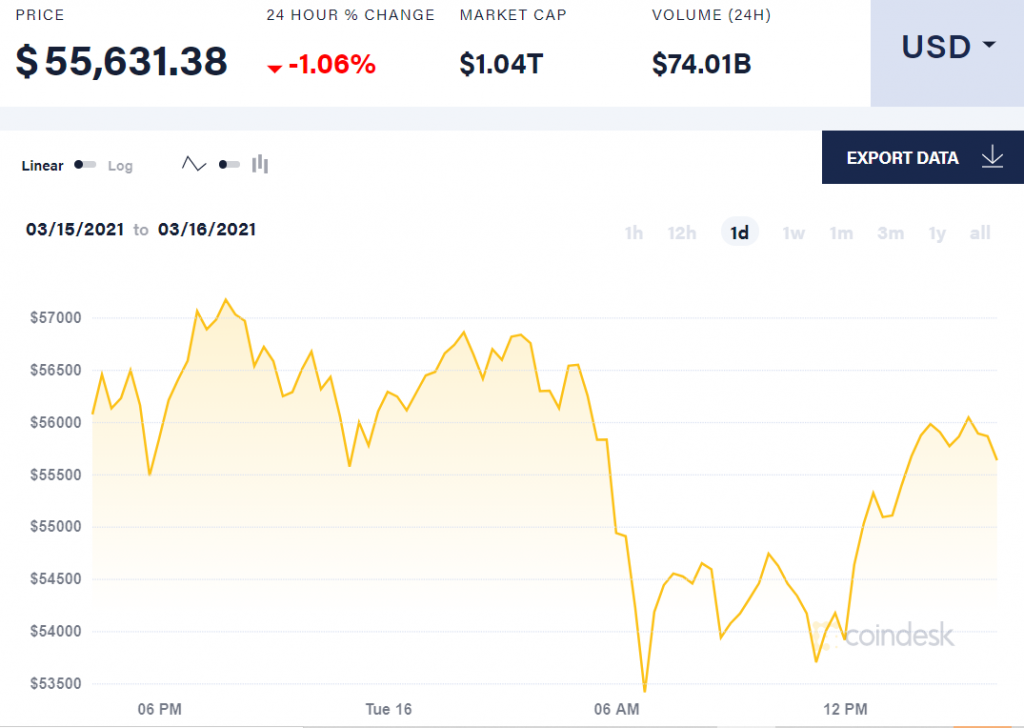

- Bitcoin fell 9% on Monday after investors took benefit of the record-breaking weekend boost.

- It climbed high as $61,742.41 on Saturday and sustained $62,000 on Sunday.

Bitcoin fell on Monday, dropping from a high of over $60,000 on the weekend, as sponsors interpreted a potential ban of cryptocurrencies from India. The cryptocurrency had kicked a record boost of $61,781.83 on Saturday after Joe Biden, the U.S. President, acknowledged his $1.9 trillion economic stimuli and commanded a dispatch in vaccinations.

Because a few investors direct to see bitcoin as a fence against inflation, researchers think steep financial recovery prospects have assisted bitcoin’s growth.

In midday trading, bitcoin was under 5.3% at $55,865. A superior government administrator informed Reuters overnight that India, which is Asia’s third-largest market, is planning a bill that would criminalize mining, possession, trading, insurance, transferring, and trading crypt-assets.

With India’s January government plan, the bill urged banning private digital currencies like bitcoin while developing a framework for its official virtual currency.

John Wu, the president of AVA Labs, which is an open-source platform to build financial apps with Blockchain technology, said, “Renewed interest from the Indian government in banning cryptocurrencies led to the initial drop from the $60,000 range down to $56,000.”

In India, notwithstanding government warnings of a prohibition, transaction amounts are expanding, and 8 million stakeholders now have ₹ 100 billion in crypto-investments, as per industry estimates.

No official information is available. The globe’s most comprehensive virtual currency reached $61,781.83 on Saturday, increasing more than 40% since February, as sponsors shrugged off issues over sky-high estimates.

Despite Monday’s pullback, various investors think the opportunity for bitcoin’s price continues turned to the upside. The Tokyo-based COO of cryptocurrency exchange Liquid, Seth Melamed, said the law of the kind India is offering would not be an obstacle to additional profits for bitcoin. He mentioned, “Because it’s decentralized, government bans or acceptance is somewhat irrelevant.“

“The reason bitcoin’s continued rise is such a surprise to the traditional financial market is because they are looking at its fundamentals, while they should be looking at the market forces driving its adoption,” stated Sergey Nazarov, Chainlink’s co-founder, a decentralized system that gives information to smart contracts. Adding further, he said, “Bitcoin is involved in the same market dynamic as all Fiat money, where market forces determine its value much more than any clear fundamentals.”