Introduction

Marking its initial launch, back in September 2013, Apple Pay, the mobile payment solution from Apple is all set to hit a wider community of users by making its official release starting from October, 2014. By using Apple Pay, the iPhone community users can do payments for all services subscribed on the iOS platform. The service will be available from gadgets starting from iPhone 6 version. Apple describes the newly launched mobile payment app to be more secure while using debit/credit card details online.

www.apple.com

User Experience

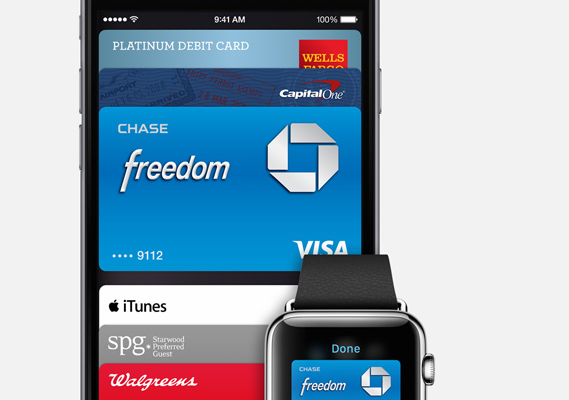

The biggest advantage of using the Apple Pay service is that the users need to carry the physical debit/credit cards as the service can directly link to the preferred card details during the payments for services. The European as well as American group of users rarely use mobile phone as a payment medium. Thus Apple Pay is expected to attract more divisions of users, making the iPhone service an inevitable factor in their online experience. Just by doing a tap on the iPhone, users will be able to make payments instantly.

How it works?

All the users will have to take a snapshot, using the device camera of their cards and load it to Passbook. Once this is added, Apple will verify the card details. The servers of Apple Pay don’t store any information related to the card. The service is expected to gain advantage over other similar services as their focus is more on user privacy and security.

How secure is Apple Pay?

With the launch of the new app, Apple is expected to abide by the quality of standards that they have managed to preserve in their previous products. Apple has already started their talks with leading retail stores, but the details of the discussions are not yet revealed. The Apple Pay is developed in a way that not even the service developers will have access to user credit/debit card details.

The use of Touch ID, a fingerprint sensor, also adds more security to the service. This prevents the service being used in case of device thefts, making the app more secure for usage. During payments, the card details are not shared with retailers. Instead a device specific generated number is shared for completing the transaction. This feature of generating unique keys for each transaction would negate the efforts of hackers to steal card details and use them illegally.

Partnerships

Many leading banks in the US are partnering with Apple Pay during its launch in October, 2014. Retail Giants Macys’, Starbucks are all in line for partnership with the service.

Prospects

A solution like Apple Pay could actually kill the existence of physical credit/debit cards and also will help to lighten the wallet. Similar services have been launched by competitors, but the success depends on how fast the services get adopted by the users, worldwide. The concept of physical wallet to be transformed to digital wallet could also be dependent on how soon retailers would get added to the newly launched service.